The increasing term insurance. Year 21 onwards till Year 40.

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

If you die during this time your beneficiary receives a death.

. The Most Reliable Term Life Insurance Providers That Have Your Interests At Heart. Ad Locked In Rate Flexible Payment Schedule And More. An incremental term insurance plan is a type of term insurance where you can increase your policy cover by a certain amount every year.

Compare Find the Best Policy For You Save. From the 22nd year of the policy there would be no further increment in assured. An increasing term insurance plan provides appropriate coverage to meet escalating financial demands as your obligations and liabilities grow in the future.

1 crore with 5 increase each year then after 10 years he or she will have a life cover of Rs15 crore. With increasing term your coverage amount will rise by increments throughout the policy term sometimes along with your premium rates. Read about it and apply for the best plan.

If you just had your first child but plan to. Increasing term is a type of term life insurance which means it lasts for a specific period such as 10 20 or 30 years. An example of the payment structure of a.

Increasing term insurance also known as index-linked life insurance is a term life insurance policy that keeps on rising in value over time. Increasing term life insurance plan know what it is how does it work and what are the benefits of buying an increasing term insurance plan on Bajaj Allianz Life. Decreasing term life policy affordable term life.

Decreasing term life insurance is a policy that like the name decreases on a monthly or annual basis. Compare Find the Best Policy For You Save. For example if you purchase a.

Decreasing term insurance is a type of annual renewable term life insurance that provides a death benefit that decreases at a predetermined rate over the life of the policy. Increasing Term Insurance Example. Protects your beneficiaries against rising inflation rates because a 200000 face value when you bought the coverage doesnt hold the.

Apply for guaranteed acceptance life insurance. How does an increasing term insurance plan work. Traditional Increasing Term Insurance is where you and your insurance provider agree on a specified rate at which the value of your policy will increase.

Options start at 995 per month. Most increasing term life insurance premiums are impacted by the age of the purchaser. The payout structure is a key difference between a DTA insurance policy and a standard term policy or term life insurance.

Increasing The Coverage. He chooses the plan. Secure your family financially by choosing Increasing Term Insurance Cover that raises the sum assured every year.

Thus your life cover plan must cater to these changing needs by increasing your term insurance cover. Some people expect their insurance needs to increase over time though. You cant be turned down due to health.

Ad Get an instant personalized quote and apply online today. For example if you choose a 250000 policy with a. Lets get to know.

Now that you have an idea about an increasing term insurance policy and how it gets adjusted to your life stages. With an increasing cover you can. Ad Our Comparison Chart Makes Choosing Simple.

Ad Locked In Rate Flexible Payment Schedule And More. For example it can be increased while. Get A Personalized Quote In Seconds.

The most obvious example is if youre repaying a mortgage. Illustration on an Increasing Term Insurance Plan. The increase will be made on your.

In those cases they may turn to an increasing term life insurance policy. Increasing Term Life Insurance Policy - If you are looking for the best life insurance quotes then look no further than our convenient service. It is uncommon but can protect beneficiaries from inflation or.

Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. If an individual buys a cover for INR. If the insured dies during the time period.

Benefits Of Increasing Term Insurance. Ad Our Comparison Chart Makes Choosing Simple. An increasing cover is a feature that systematically and automatically increases your cover amount without medical tests or documents.

The increasing term insurance plans are specifically designed keeping in mind the changing circumstances of individual life and the increasing inflation rate. Consider the following example to understand the working of an increasing term insurance plan. Do Increasing Term Life Insurance Premiums Go Up With Age.

Ms Preeti bought an increasing term. So here is an illustration of an increasing term insurance plan Example Anil aged 40 years buys an increasing term insurance plan for a sum assured of Rs20 lakhs. Increasing term life insurance policy is a type of term life insurance with a death benefit that increases over time.

Get A Personalized Quote In Seconds. Along with the benefit of. The Most Reliable Term Life Insurance Providers That Have Your Interests At Heart.

What Is Whole Life Insurance Cost Types Faqs

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Term Vs Whole Life Insurance 2022 Guide Definition Pros Cons

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Insurance Resume Example Sample Resume Examples Good Resume Examples Executive Resume

How Much Life Insurance Should You Carry

157 Reference Of Auto Insurance Out Of Pocket Car Insurance Home Insurance Quotes Life Insurance Quotes

What Is Life Insurance Life Insurance Definition Meaning Icici Prulife

What Is Life Insurance And How Does It Work Money

Awesome Outstanding Keys To Make Most Attractive Business Owner Resume Check More At Http Snefci Resume Examples Retail Resume Examples Small Business Owner

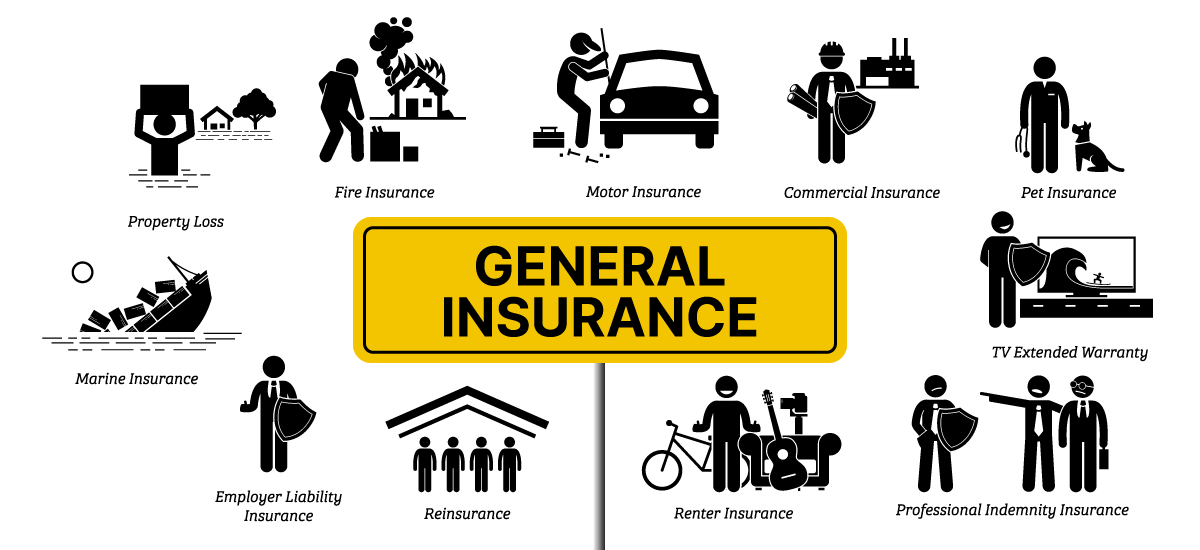

Non Life Insurance Policy Types Features And Benefits

Term Vs Whole Life Insurance 2022 Guide Definition Pros Cons